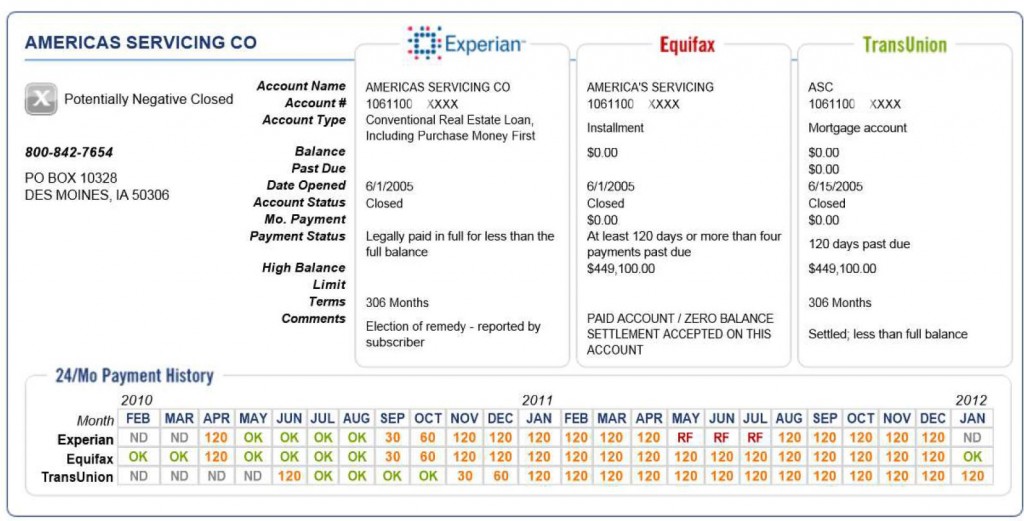

A number of our past clients have short sold their primary residences, second homes, their non-performing investment properties, and their commercial real estate properties. Trimming your financial landscape and downsizing your debt is not a bad exit strategy. Our past clients who have short sold are ready to repurchase another home, investment property or refinance their existing home. When it comes to short sales, expect erroneous reporting on your credit, especially with encoding errors, payment status, payment history and comments from the credit bureaus and the creditor. For Example: You short sold your investment property; however, your creditor and the credit bureaus are reporting it as a foreclosure with the credit encoding, payment status and comments (See Exhibit A)

The creditor reported my client with a three times RF encoding which means “repossession or foreclosure” on a property he short sold. Also, notice the different comments, payment status and the payment history, they are reported differently to each credit bureau.

Time is Money

Even if “Fannie Mae is updating its automated underwriting system to allow lenders to disregard erroneous foreclosure information…” this is not a fix on your credit. So now what? You would definitely dispute the erroneous reporting of your short sale with your creditor and the credit bureaus. Fixing erroneous mortgage payment history, encoding errors, payment status and comments on your credit takes time and dedication. If you plan to fix your credit on your own know this: Do not incorrectly aggravate your creditors and the credit bureaus, by doing so, you will not succeed in removing your deragotories. Disputing your credit derogatories incorrectly on your own will cost you time and also not having the results you were anticipating for. In addition, stay away from these generic scanned computerized credit repair programs you typically see online, they will not manually audit the short sale with the lender. You can simply check your credit with one of these three reputable sites, Equifax, Experian or MyFICO.

You are better off hiring a credit restoration expert who customizes your credit restoration to your circumstances. For example: My client and his wife short sold their investment property 16 months ago, now they are opting to refinance their primary residence. My client and his wife understand their lender and the credit bureaus erroneously reported their short sale by incorrectly reporting their payment history, payment status and comments. My client called us because his brother is a past of client of ours and has seen the hands on results of our customized credit restoration program we put together for our clients.

Allow us to help you save you time and money by enrolling in our credit restoration process. Be prepared to fully commit to our credit restoration process that is tailored to each individual’s circumstances. Our consultations are free!

Related Articles:

- Having Good Credit Scores Has It’s Perks

- Keep Calm and Fix Your Credit

- Four C’s of Credit Repair

- We Go the Extra Mile and it’s Never Crowded

- Keeping Bad Credit Costs You More than Good Credit

For more information on how we can help you restore credit from your previous short sale and foreclosure locally in Palm Beach FL and Palm Beach Gardens FL, please fill out the online contact form about your concerns or give us a call at 855.477-9007 . Read what our valued clients have to say about First Pro Capital and Credit Consulting Professionals on our Testimonials page.

~ Allow our team of professionals to assist you!

Leave a Reply