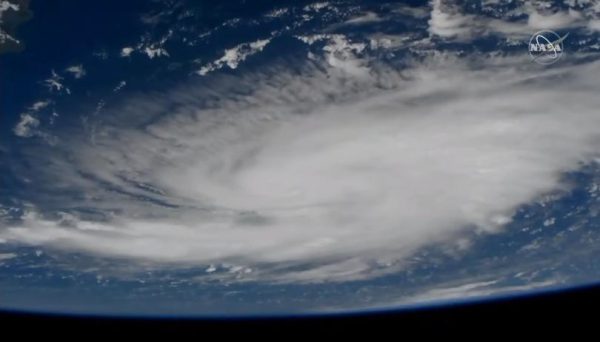

Unfortunately, natural disasters happen and when they happen, your personal credit, your mortgage and your income can be affected. Here are four simple steps that may help you after Post Dorian.

Take Photos of Your Property Before and After

It is imperative to take photos of your property before a hurricane or a natural disaster happens to your area. After the natural disaster occurs and if there are a number of damages, take photos of the aftermath. You can forward the photos to your lender, especially if it is not liveable. When your property is not liveable and your insurance company pays less than what you owe to your mortgage company, you have the opportunity to settle your mortgage for less than what is owed. This all depends on on what your insurance claim covered and how much and also how you package the settlement offer to your lender. For example: A a client from Long Island was affected by Hurricane Sandy, the damages on her property were awful and the property was no longer liveable. Sadley, the insurance company gave my client less than what was owed to Bank of America. My client contacted me and asked me to intervene with Bank of America because she could not settle the account on her own with the customer service representatives she was dealing with. I contacted my executive contacts at Bank of America, we enforced the settlement offer through other channels at Bank of Amercia. The file was thorough, we included figures from the insurance company, the amount the insurance company shorted the payoff to Bank of America, documentation from a contractor that the property must be torn down because it was no longer liveable and also an excessive amount of photos of post-hurricane Sandy damages. With speaking to the correct executives at Bank of America and a very thorough settlement packet, Bank of America accepted my client’s short pay off due to her property was no longer liveable and evidence of the enormous amount of damages.

Keep all Documents from Your Insurance Adjuster

Your insurance adjuster will determine the amount of proceeds the insurance company will pay out for your property damages or how much the insurance company will reimburse your mortgage company, only if the property is not liveable. If they shorted your mortgage company’s amount of the payoff, it is critical to furnish your insurance claim to your mortgage company and start your settlement packet.

Ask for a Disaster Relief Forbearance Plan

If your property is liveable with repairs ask for a disaster relief forbearance plan. Fannie Mae and Freddie Mac both allow a disaster relief forbearance plan, keep in mind you’re lender cannot report late payments during a disaster relief forbearance plan. A disaster relief forbearance plan is an option for a consumer who took a temporary loss of income during a hurricane or other types of natural disasters.

Check Your Credit Report After Your Disaster Relief Forbearance Agreement

When you enter a disaster relief forbearance agreement with your mortgage company, verify you are not reported late on your credit report. A creditor cannot report a consumer late during a disaster relief forbearance agreement. If your lender reports you late while you entered a disaster relief forbearance agreement you must dispute the late payments off your credit report.

For more information on how we can help you with your personal credit or business credit after Hurricane Dorian in Palm Beach, Delray Beach and Fort Lauderdale please fill out the online contact form about your concerns or give us a call at 855.477-9007. Read what our valued clients have to say about First Pro Capital and Credit Consulting Professionals on our Testimonials page.

~ Allow our team of professionals to assist you

Leave a Reply