Business identity theft is one of the fastest-growing forms of financial crime in the United States. As cybercriminals become more advanced, business identity theft and personal identity theft are increasingly connected, creating serious financial, legal, and reputational risks for companies of all sizes.

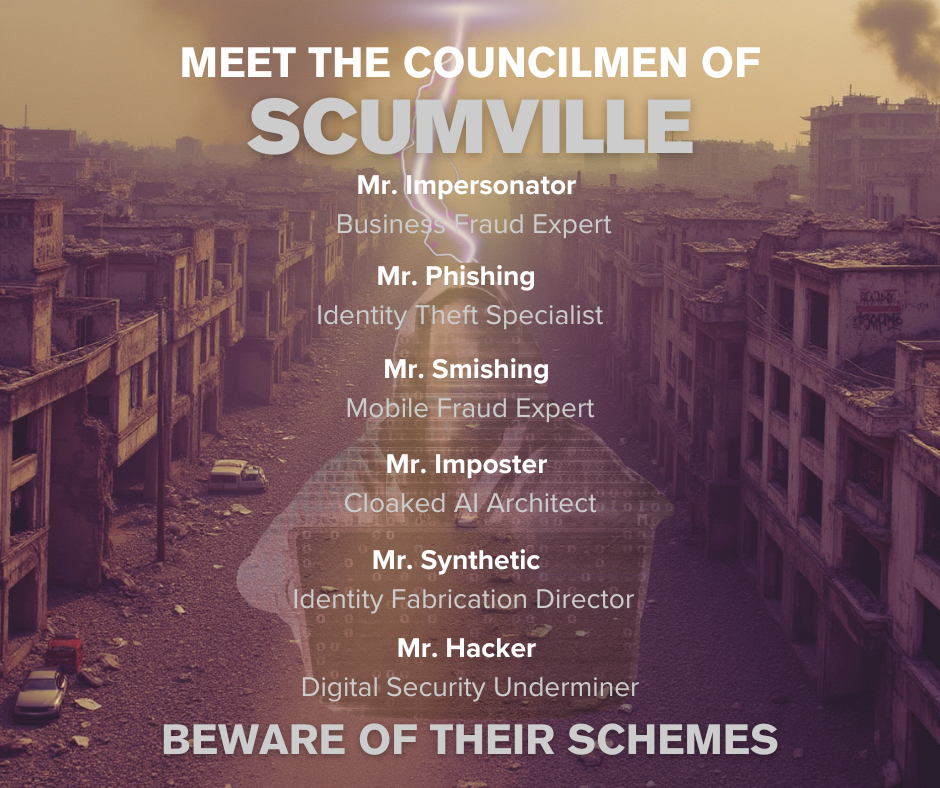

With the rise of artificial intelligence (AI), phishing scams, smishing attacks, impersonation fraud, and synthetic identity theft, businesses are being targeted more aggressively than ever before.

What Is Business Identity Theft?

Business identity theft occurs when criminals steal or misuse a company’s identifying information, such as an EIN, business name, business credit profile, domain name, or social media presence to commit fraud.

This often includes:

- Fraudulent business loans and credit lines

- Fake vendor accounts and payment diversion

- Impersonating the business to scam customers

- Damaging a company’s business credit score

In many cases, business identity theft begins with personal identity theft of a business owner, officer, or authorized signer.

The Connection Between Personal Identity Theft and Business Identity Theft

Small businesses and mid-size businesses are particularly vulnerable because personal and business data frequently overlap. Criminals exploit this connection by targeting:

- Personal social security numbers linked to business credit

- Personal email accounts used for business access

- Shared passwords across business platforms

- Public social media profiles revealing personal details

Once personal identity theft occurs, it becomes much easier for fraudsters to infiltrate business systems and steal a company’s identity.

How Artificial Intelligence (AI) is Accelerating Business Identity Theft

AI has transformed cybercrime. Fraudsters now use AI-powered tools to scale and perfect business identity theft schemes, including:

- AI-generated phishing emails that mimic legitimate vendor

- Deepfake voice impersonation of CEOs and executives

- Automated smishing campaigns via SMS

- AI-driven data scraping from LinkedIn, Instagram, and business websites

These AI fraud tactics make identity theft harder to detect and significantly more costly for businesses.

Common Business Identity Theft Scams Targeting Companies

Phishing and smishing attacks are the most common tactics used for business identity theft.

Phishing scams (email) and smishing attacks (text messages) are designed to trick business owners and employees into sharing login credentials, banking details, or EIN information.

These attacks often appear to come from:

- Banks or lenders

- Payroll providers

- Vendors or suppliers

- Government agencies

Executive and Vendor Impersonation Fraud

Impersonation fraud is one of the most damaging forms of business identity theft. Criminals pretend to be:

- CEOs or business owners

- CFOs or accountants

- Vendors requesting payment changes

AI-generated voices and spoofed email domains make these scams extremely convincing.

Synthetic Identity Theft and Business Credit Fraud

Synthetic identity theft combines real data, such as an EIN or partial social security number with fake information to create a new identity. Criminals use synthetic identities to:

- Build business credit over time

- Open trade lines and credit accounts

- Apply for large loans under a stolen business identity

This form of fraud often goes undetected until severe financial damage occurs.

Fake Businesses and Social Media Imposters

Criminals increasingly impersonate legitimate businesses online by stealing:

- Logos and branding

- Website content

- Social media photos and videos

- Customer reviews and testimonials

These imposters use fake social media accounts and ads to scam customers, collect payments, and destroy brand credibility.

Fraudulent Business Filings and EIN Abuse

Fraudsters may file fake documents with state agencies, alter business records, or open credit accounts using stolen EINs—resulting in business credit report damage and legal exposure.

The Cost of Business Identity Theft

The impact of business identity theft goes far beyond financial loss. It can lead to:

- Damaged or destroyed business credit

- Denied loans and frozen accounts

- Compliance and legal issues

- Loss of customer trust

- Long-term reputational harm

Many businesses don’t realize they’ve been compromised until months later.

How to Protect Your Business from Identity Theft

Preventing business identity theft requires a proactive approach:

- Separate personal and business identities

- Monitor business credit reports regularly

- Secure EINs and business registrations

- Use multi-factor authentication

- Train employees on phishing and impersonation scams

- Monitor social media and brand impersonation

- Invest in business identity theft monitoring services

Business Identity Theft is a Growing Threat

As AI-powered fraud continues to rise, business identity theft is no longer optional to address—it’s essential. The overlap between personal identity theft and business fraud makes business owners especially vulnerable.

Protecting your business identity today can prevent devastating financial and reputational losses tomorrow.

For more information on how this Florida boutique firm can help you with fixing your business identity theft , please fill out the online contact form about your concerns or give us a call at 239.260.4602. Read what our valued clients have to say about First Pro Capital and Credit Consulting Experts on our Testimonials page.

Leave a Reply