This is just a follow up about how excessive mortgage inquiries impact your credit scores

Since the lending industry strengthened, yet again we see unprofessional mortgage and commercial banking representatives who freely pull credit without the borrower’s authorization, believing their credit scores may increase just a little to get them qualified for a loan. A smart and seasoned mortgage or commercial loan officer never pulls credit more than once during a 30 day period, unless it was a Rapid Rescore request. Lately, unauthorized credit inquiries are becoming more common, We have seen some unprofessional mortgage representatives and commercial loan officers who pull excessive credit inquiries within less than 30 days.

If you visit an online site for competitive rates, believe it that your credit report will be pulled by more than one lender, which will cause excessive and unnecessary hard credit inquiries on your credit report. Excessive credit inquiries reduce your credit scores. A referral to a mortgage banker or mortgage broker is the key, it will allow you to save time, money and not hurt your credit scores.

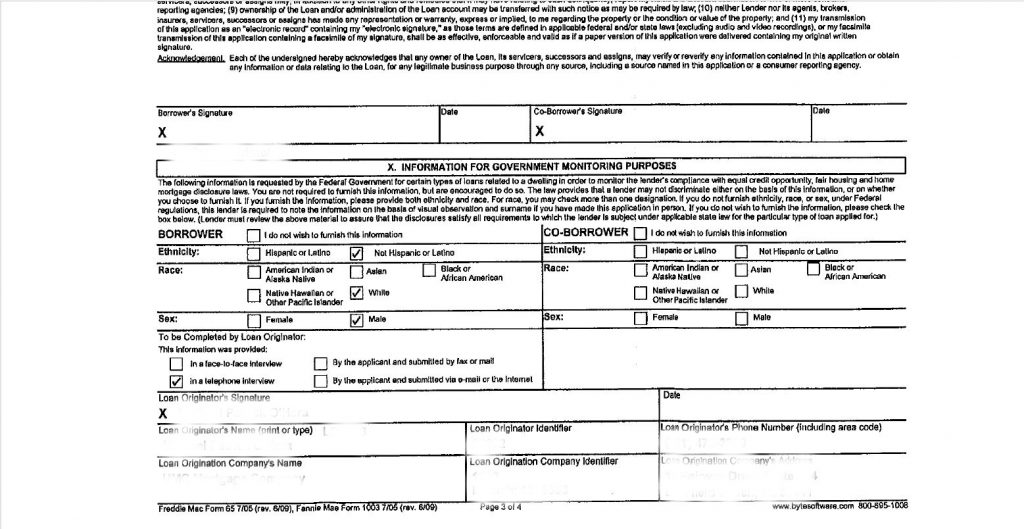

We have displayed a recent dispute for a client’s unauthorized credit inquiries. The mortgage loan officer pulled two credit inquiries within two days and another mortgage inquiry after one week, a total of three. My customer was just curious about what the interest rate was; he was unfamiliar with the mortgage professional and did not realize he was taking a mortgage application. (Please note, the client’s personal information and the mortgage company’s information were blotted out due to privacy rules)

After we requested an investigation with the credit agency that provides credit reports for lending institutions, for their defense, the lender provided a blank and undated credit application, besides not furnishing a credit authorization form that my client never signed. Fast forward, the third party credit agency stated our dispute is accurate and valid, and processed the removal of three unauthorized credit inquiries.

In addition to our correspondences, we processed the mortgage inquiries dispute for the client’s behalf with all three credit bureaus, Transunion, Equifax and Experian. The first process was completed in 15 days and the final process was completed 15 days after initiating the unauthorized credit inquiries, a total of 30 business days to remove three unauthorized credit inquires.

Now, the choice is yours for a free thorough credit consultation

For more information on how we can help you with your personal credit or business credit locally in North Palm Beach and Jupiter FL please fill out the online contact form about your concerns or give us a call at 561.244.9914. Read what our valued clients have to say about First Pro Capital and Credit Consulting Experts on our Testimonials page.

Leave a Reply